Canadian Bitcoin mining company Bitfarms saw its stock surge nearly 22% following the release of its better-than-expected second-quarter earnings on August 8. The Bitcoin miner reported a loss of 7 cents per share, significantly less than the 11 cents per share loss forecasted by Zacks Investment Research.

Stock Boost and CEO’s Optimism

Bitfarms’ stock price climbed nearly 22% in a single day, reflecting investor optimism. Newly appointed CEO Ben Gagnon took to social media platform X to express confidence in the company’s growth trajectory. “We continue to dramatically alter our operating profile via our ongoing fleet upgrades and our geographic expansion,” he stated. Gagnon also hinted at the company’s exploration of opportunities beyond Bitcoin mining, including ventures into High-Performance Computing (HPC) and Artificial Intelligence (AI).

Revenue Decline Linked to Bitcoin Halving

Despite the stock surge, Bitfarms reported a total revenue of $42 million for Q2, marking a 16% decline from the previous quarter and falling short of analyst estimates. The company attributed the revenue drop to the reduced block rewards following the Bitcoin halving on April 19. The halving, a scheduled event in the Bitcoin protocol, cuts mining rewards by 50%, with miners now receiving 3.125 BTC per mined block, down from the previous 6.25 BTC.

Operational Challenges and Strategic Investments

Bitfarms also reported operating losses of $23.6 million, including $46 million in accelerated depreciation on older mining equipment. Despite these challenges, the company remains committed to its growth strategy. In April, Bitfarms announced plans to invest approximately $240 million to upgrade its mining equipment and add 88,000 new miners.

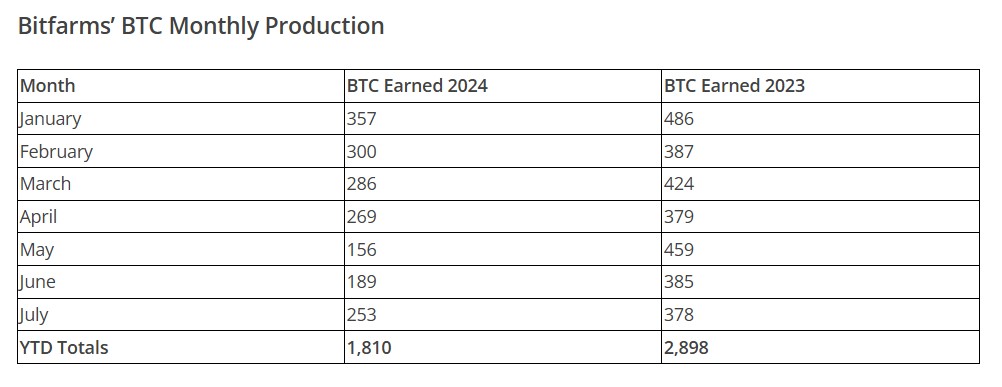

Bitcoin Production and Rising Costs

During Q2, Bitfarms mined 614 BTC, valued at approximately $37 million at current market prices. However, the total cash cost of production per Bitcoin rose sharply to $47,300, up from $27,900 in the first quarter of 2024. This increase reflects the rising costs associated with mining operations.

Expanding Hashrate and Future Growth Plans

Bitfarms has also made significant strides in increasing its hashrate, which measures the processing and computing power of its mining operations. The hashrate jumped to 11.1 EH/s, up from 6.5 EH/s. Gagnon highlighted that the company’s new site in Sharon, PA, along with new megawatts in South America, will further boost the hashrate, positioning Bitfarms to reach over 35 EH/s by 2025—a 67% growth from the year-end target of 21 EH/s.

Future Outlook and U.S. Expansion

Looking ahead, Bitfarms plans to continue its aggressive growth strategy, with a sharp focus on expanding its operations in the U.S. and diversifying beyond Bitcoin mining. As the company navigates the challenges of the volatile cryptocurrency market, its commitment to innovation and expansion remains at the forefront of its strategic objectives.